If you’ve ever had to chase unpaid invoices, this blog is for you…

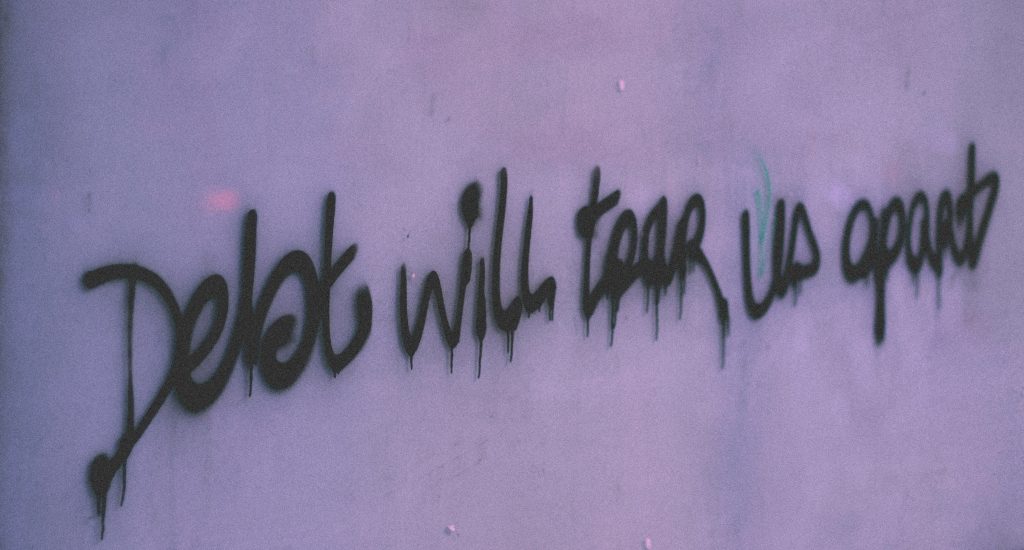

Any small business owner will probably have a few stories about unpaid invoices. To a sole trader or entrepreneur, the lack of payment for work carried out in good faith represents a uniquely frustrating issue. It can also have a disproportionately large impact on profitability, affecting everything from overdraft charges to the person or company’s ability to pay salaries and dividends. This situation is compounded by the effort required to claw back owed monies, often from companies who are desperate to stall and procrastinate until the last possible moment.

This is the situation G75 Media recently found itself in. We’re no strangers to unpaid invoices – of the 96 invoices we filed one year, 21 were paid late (though all were eventually settled). Every late payment had to be laboriously chased up, while three overdue invoices from one particularly troublesome client led to debt recovery proceedings. We’d worked with this client on a weekly basis since May 2014, but our working relationship ended as a direct result of these payment issues.

What can you do to protect yourself against unpaid invoices?

Ultimately, even the most organised of sole traders and small businesses may find themselves out of pocket if a client isn’t able or willing to settle on time. However, these steps should help to minimise the risk of clients making a conscious decision not to pay what they owe:

- Make your payment terms clear at the start of any working relationship. Inform a new client in writing that your invoices will require settlement within a specific time period. Ideally, you should request client confirmation that they approve these terms – a one-sentence email from your main contact is perfectly sufficient.

- Submit invoices on a regular schedule. G75 Media invoices every client on the last working day of each month. Each invoice contains an itemised list of work carried out that month, leaving no ambiguity about what has (and hasn’t) been done.

- Include bank details on the invoice. Clients can’t stall by claiming ignorance about payment methods if each invoice lists your bank’s sort code and account number. Publish details of your payment terms and add a sentence like “unpaid invoices may be handed over to a debt collection agency” for clarity.

- Don’t accept cheques. Some firms in more traditional industries still prefer to pay by cheque, which provides an ideal excuse if payment isn’t received – “it must have got lost in the post”. Cheques can also bounce, unlike a BACS transfer.

- Keep a detailed spreadsheet with notes of every submitted invoice number, the date it was submitted, and who it was sent to. This allows you to see at a glance whether any invoices from previous months are still outstanding. G75 Media’s policy is to begin chasing up invoices on the last working day of the month after submission.

- Don’t pursue unpaid invoices by phone. Instead, forward your original invoice-bearing email to the client with a note asking them to ensure settlement within an acceptable time period. A single email thread is far tidier than multiple ones, especially if messages subsequently end up flying back and forth between different people/departments at the client’s side.

- Remain calm. If clients are happy to default on an invoice due date, they’re not going to be swayed by the knowledge you can’t pay yourself a dividend. Emotional appeals will cut no ice, and nor will (understandable) frustration. Remain calm, factual, polite and unapologetic in requesting what’s rightfully yours.

- Set a deadline. Instead of tossing and turning in bed at night, set a point at which you will delegate matters to a specialist (see point 9 below). G75 Media gives companies one month’s grace to resolve outstanding invoices, which are occasionally caused by an account manager forgetting to forward them on and thereby missing that month’s payment cycle.

- Instruct a debt recovery firm to issue a Letter Before Action. You might need to use specialist firms if the client is based in a different part of the UK, or overseas. The company G75 Media uses has had very positive results with LBAs, which are emailed and posted to the client. At this point, you may have to withdraw from any further correspondence.

- If the LBA doesn’t work, initiate full debt recovery proceedings. This will cost a significant percentage of your original invoice, and many debt collection firms won’t be interested in three-figure sums. Even so, it’s better to get 75 per cent of something than 100 per cent of nothing. This is the point where you step back entirely, and let events run their course.

Because we’ve always taken a proactive approach to unpaid invoices, G75 Media has endured very few bad debts in our 16-year history. One or two firms went bust before they paid us (including the failed publishing house Prior & Partners and the endlessly rebranding commercial property developer then known as Fresh Start Living), while a couple of entrepreneurs saw an opportunity to simply vanish and block all attempts at contact. However, it’s been years since we last submitted an invoice which was subsequently written off as a bad debt.

Today, G75 Media is discerning about the companies we work for, conducting Companies House checks and researching each prospective client. We submit a legally binding, solicitor-approved contract for services to new clients before work commences, insisting they agree to various terms (including payment schedules) before work commences. And we don’t continue working with companies who have more than one outstanding invoice – our resources are too precious to waste on non-payers!

We would urge anyone with a small business to follow the advice outlined above. Due diligence and a detailed paper trail won’t always protect you from defaults, but it should minimise the number of unpaid invoices appearing on your year-end balance sheet…